Easify V4 is no longer supported and has been superseded by Easify V5.

Finance - Accounts

In easify when we talk of 'Accounts' we always refer to actual accounts such as Current Account, Cashbox, Till, Loan Account etc... and not accounts as in 'I am always behind in doing my accounts.'.

When you install Easify you are given a default set of accounts that is intended to suit many small businesses.

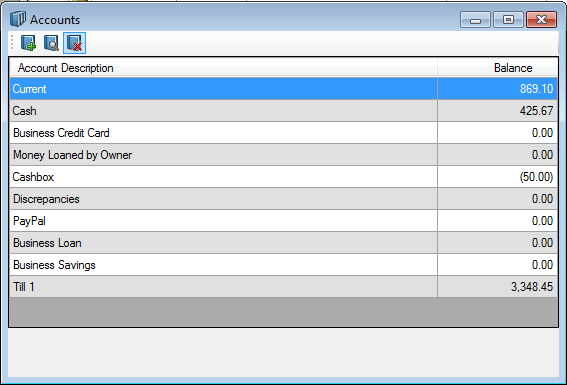

You can view your accounts in Easify via the Finances->View Accounts... menu.

This simple view shows you all of your accounts, along with their present balances. Here you can see the default set of accounts that is created for you by default.

Accounts are used in Easify when taking payments for orders, or when making payments for purchases. When taking payments for an order money will (usually) move into an account, when making a payment for a purchase money will move out of an account.

Accounts are also used when dealing with cashing up discrepancies on tills. By default Easify creates a Discrepancies account, any discrepancies found when cashing up a till will be automatically transferred to or from the discrepancies account.

You can use the Easify cashbook to view the various transactions that flow into and out of your various accounts.

Adding Accounts

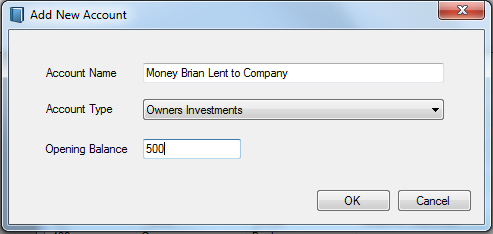

To add a new account click the Add New Account button in the Accounts window.

In the Add New Account window enter the name of your new account, select the type of the account and set an opening balance for the account if necessary.

Click OK to create the new account.

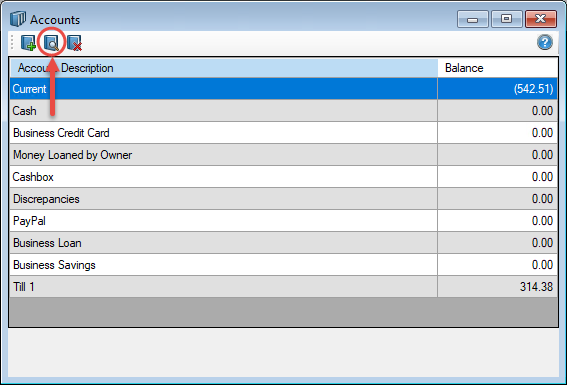

Editing Accounts

To edit an account, double-click on an account in the list, or single-click an account to select it and then click the Edit button:

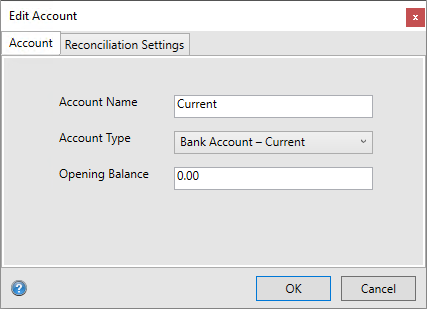

Accounts tab

On this tab you can change the account's name, type and balance.

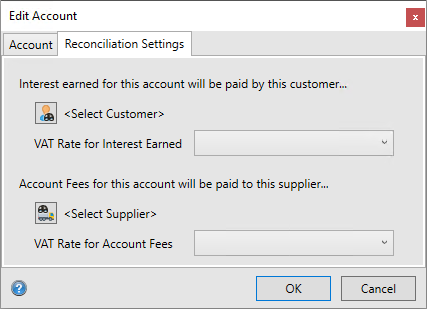

Reconciliation tab

On this tab you will need to set up reconciliation details for each account you wish to reconcile

Customer / VAT Rate for Interest Earned

In order for you to receive a payment for your Interest Earned, Easify will need you to select a ‘Customer’ – in most instances this will be your bank as they will be paying you interest on any savings you might have. Also remember to select the VAT code – in most instances in the UK this will be E (Exempt) but check with your accountant if you’re not sure.

Supplier / VAT Rate for Account Fees

In order for you to make a payment for your Account Fees, Easify will need you to select a ‘Supplier’ – in most instances this will be your bank as they will be charging you fees to use your bank account. Also remember to select the VAT code – in most instances in the UK this will be O (Outside the Scope of VAT) but check with your accountant if you’re not sure.