Easify News - 17th April 2023

Easify V4 - Update #16 (4.80) has been released...

We are pleased to announce that Easify V4.80 has been released.

For Easify V4.80 we've included the ability to adjust a VAT return if you are advised to do so by your accountant or HMRC. Plus we've also fixed a number of minor bugs that were reported since the previous update.

Take me straight to the download!

You can download the latest version of Easify Version 4 here...

What's new in Easify version 4.80?

Highlights...

- Introduced new VAT adjustments functionality.

- Moved all VAT functions under the Finances menu so they are all now located in the same place.

- Fixed error whereby Easify minimises a product after editing if other programs are open.

- Fixed error which can occur when opening the products window if the products window was very narrow when it was last closed.

- Fixed error whereby the products window can end up off screen.

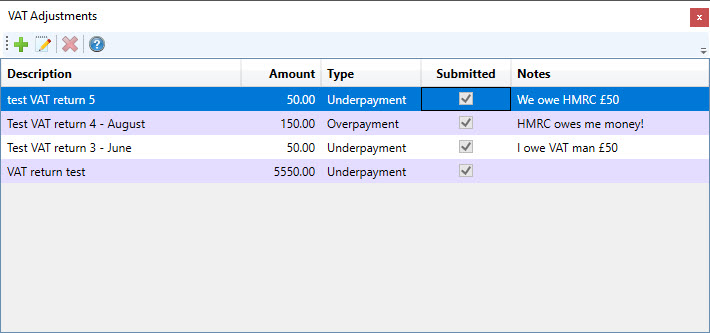

VAT Adjustments

We have had requests to introduce a VAT adjustment feature, enabling you to adjust the VAT owed in your next VAT return.

All VAT functions (VAT returns, VAT Settings and VAT Adjustments) are now located under the Finances menu, so they are altogether and easily accessible.

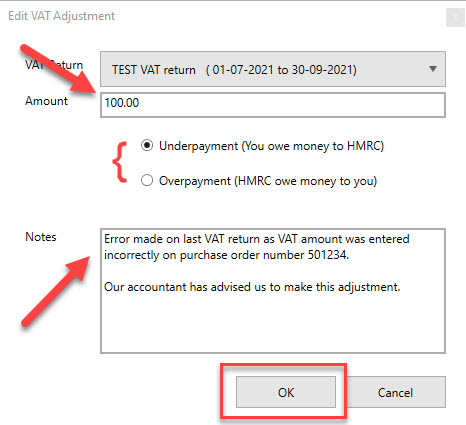

Here you can raise a new VAT adjustment against a current VAT return.

This can be raised as either an overpayment or underpayment and it will adjust your VAT liability accordingly.

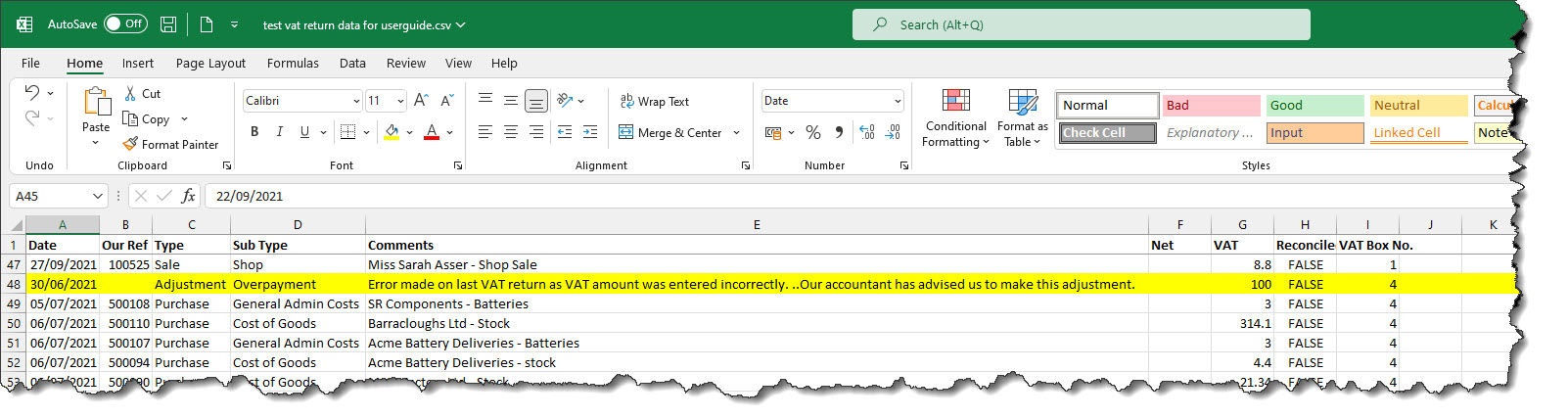

You can add comments to the adjustment to describe why it is being raised and the adjustment will clearly show on the .csv export report in order to distinguish it from other transactions on the report.

Please note: We only recommend using the VAT adjustment facility if you are advised to adjust your VAT by your accountant or HMRC.

Bug Fixes

We've included a number of bug fixes in this release which are outlined in the Highlights above.

Thank You!

Many thanks to everyone that has helped us by submitting bug reports. Please don't hesitate to let us know if you encounter problems ASAP and we will get them resolved as quickly as we can.

FAQs

I have an Easify Cloud Server, how do I upgrade?

With the Easify Cloud Server, we handle your Easify Server upgrades for you. Simply send us an email telling us when is a convenient time for the upgrade and we will upgrade your Easify Server to the latest version.

I am an Easify V4 user, are there any technical reasons that would prevent me upgrading to V4.80?

No, anyone who is using Easify V4 will benefit from the update.

You can download the latest version of Easify Version 4 here...