Who You Owe Money Report (Aged Creditors)

In Easify we try to simplify things as much as possible so rather than business owners having to remember if suppliers are Creditors, or Debtors we simply call the reports what they are.

Therefore the Who you owe money report will tell you which Suppliers you owe money to. It is the same as an Aged Creditors Report.

This report will show you which of your suppliers you owe money to at any one time, taking their payment terms into account. At the end of your financial year, your accountant will include these figures in your accounts, as even though you might not have made payment yet, the purchase has still been made in that year.

At the top of the report you will see a summary of how the report is compiled. It is ordered alphabetically by the Supplier's Name and will show any active purchases that you have received the invoice for, but not yet paid.

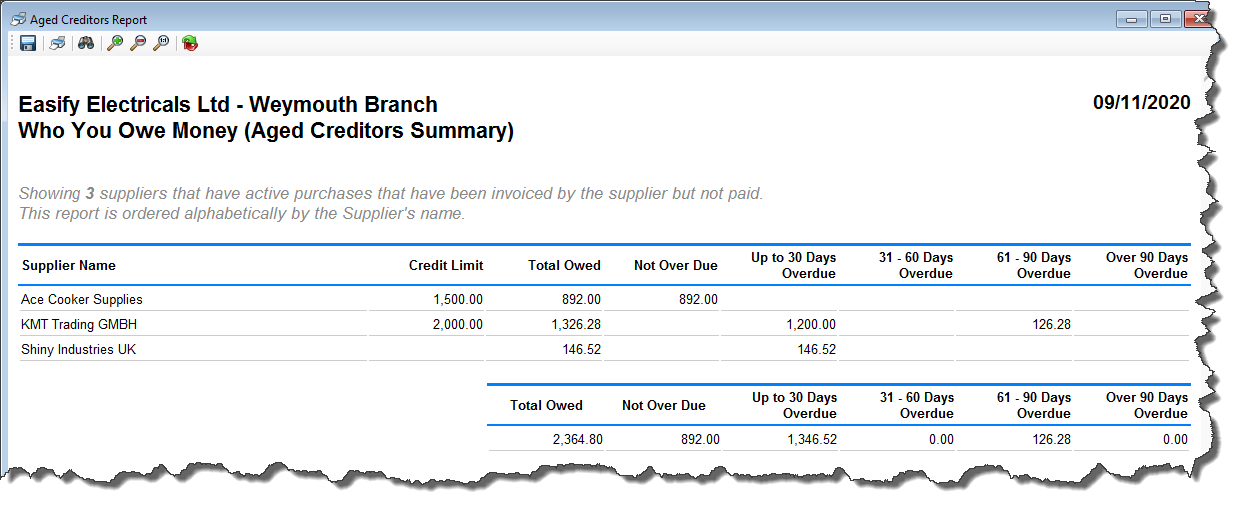

The image below shows a very simple Who you own money report with 3 examples:

Examples:

Note: Today's date in these examples is 9 November 2020 (as shown in the top right hand corner of the report).

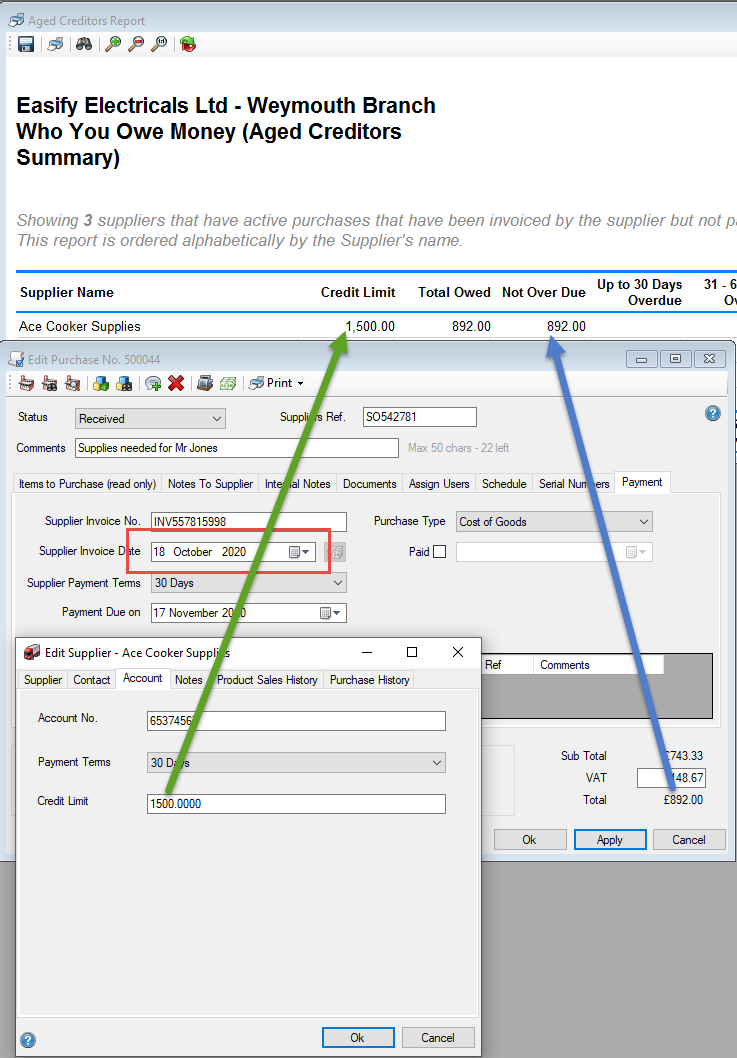

Example 1:

Let's take the first supplier on the list, Ace Cooker Supplies.

- From this report you can see that they have given us a credit limit of £1,500 which we have 30 days to pay in. (You can check set a Supplier Credit Limit and Payment Terms on the Edit Supplier window).

- We have purchased £892.00 worth of goods from them which was invoiced on the 18 October. (You can check the invoice date on the Payment tab of a purchase).

- As we have 30 days to pay them in, payment isn't due yet and hence the invoice is showing in the Not Overdue Column.

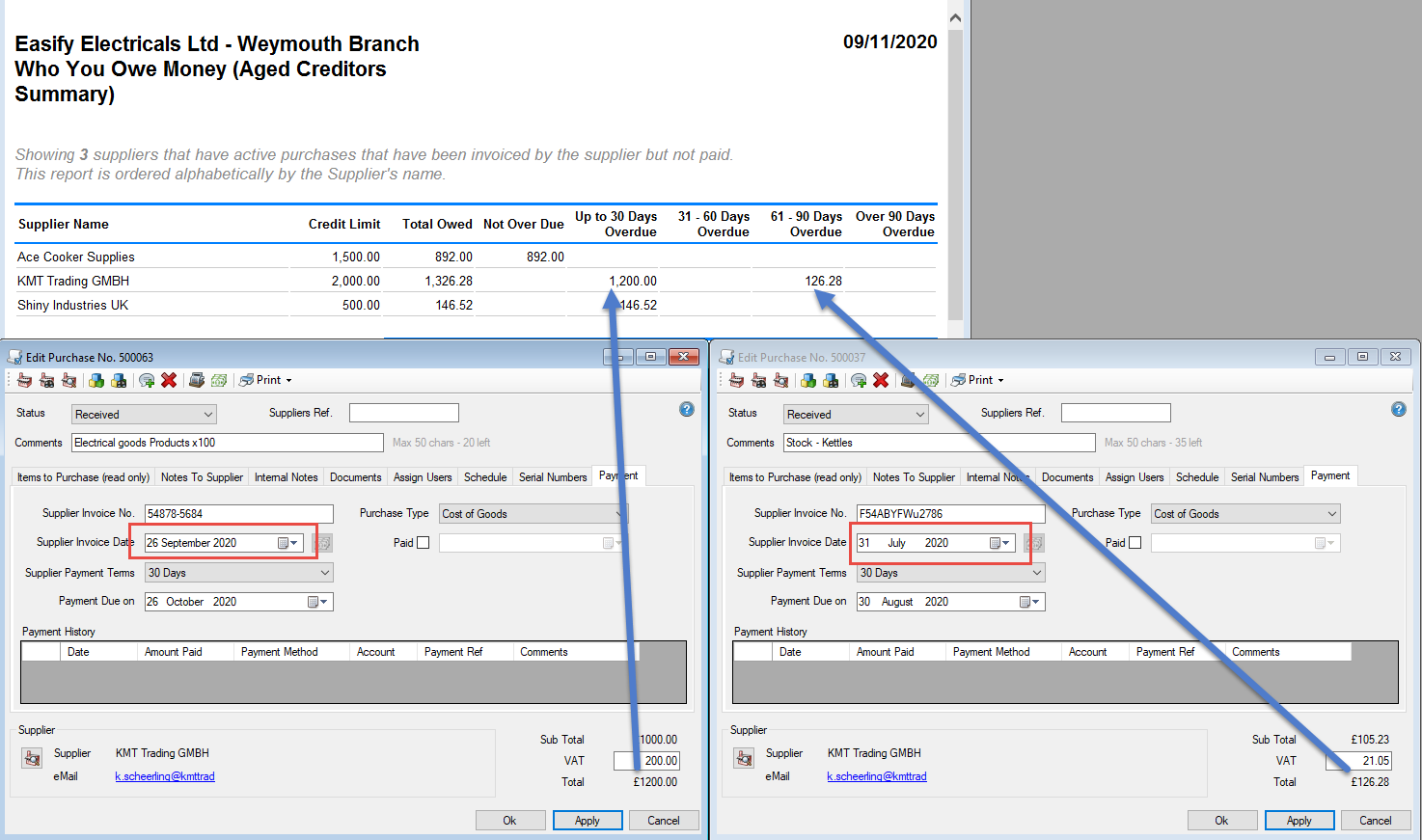

Example 2:

Let's take the second supplier on the list, KMT Trading.

- From this report you can see that they have given us a credit limit of £2,000 which we have 30 days to pay in.

- We have placed two purchases with them for a total of £1326.28 worth of goods. The first purchase for £126.28 was invoiced by our supplier on the 31 July but for some reason we haven't paid this. Perhaps it's being disputed. You can use the Internal Notes system to keep a note of all your conversations with your suppliers if that was the case. This purchase is showing in the 61-90 Days Overdue column.

- The second purchase for £1200 was invoiced by our supplier on the 26 September. As we have 30 days payment terms with them, this is overdue by a couple of weeks. Therefore this purchase is showing in the Up to 30 Days Overdue column.

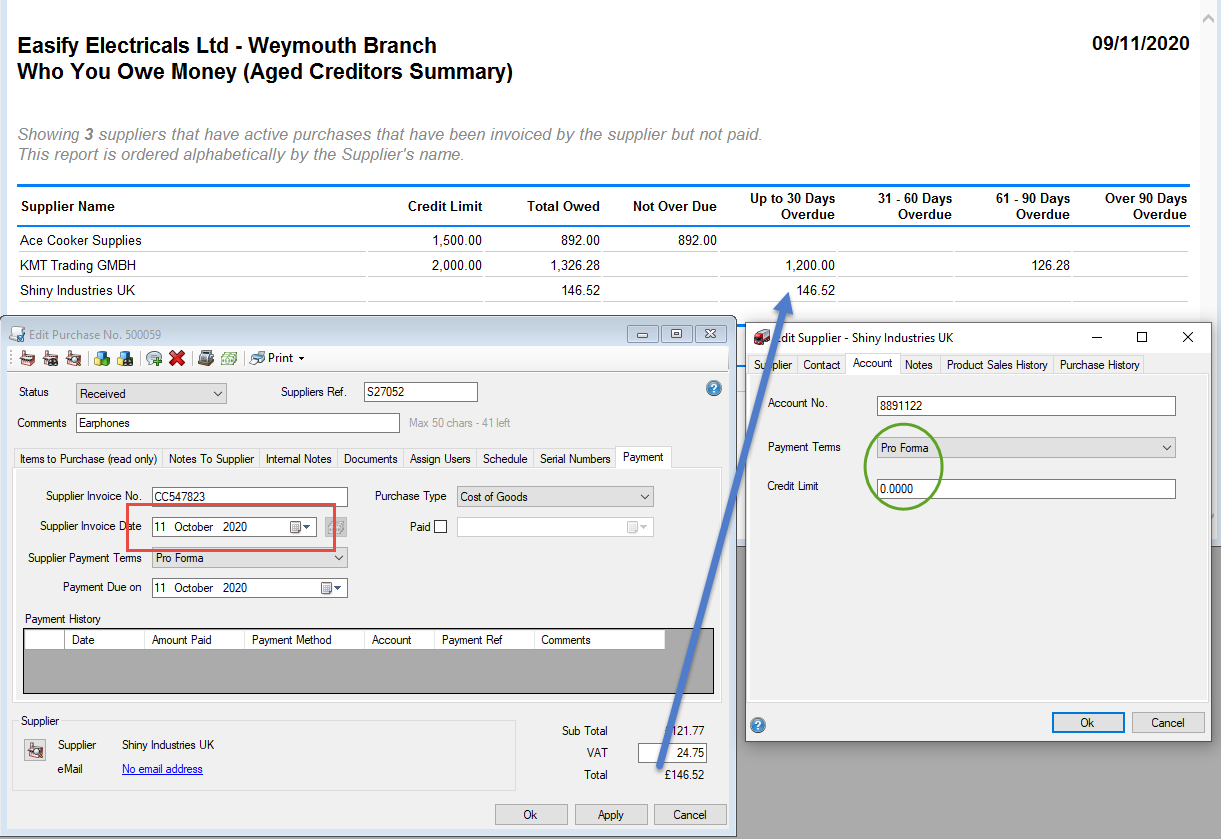

Example 3:

Let's take the third supplier on the list, Shiny Industries UK.

- From this report you can see that they haven't given us a credit limit, nor do we have payment terms with them, so we should have paid for this purchase Pro Forma (i.e. in advance) or On Receipt.

- We have purchased £146.52 worth of goods from them on the 11 October. As we don't have payment terms with them, we should have paid this invoice when we received it. Therefore it is showing in the Up to 30 Days Overdue column.

Things to note:

- You can only run off the report with todays data, not retrospectively. Therefore it is a good idea to run this report at the end your financial year, or at months end, if you need the data for your records.

- You can save this report to .pdf using the save function.

- You can print this report too using the print function.

- You can use the Binoculars to search for a product category on the report.

- You can use the Refresh button to refresh the data.