Selecting your VAT status

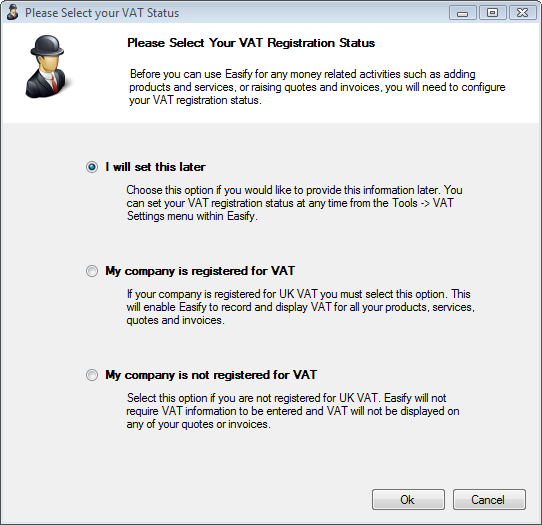

If you have had a play with some of the buttons in Easify Pro, you will probably have been greeted by this popup window:

If you choose "I will set this later" you can close the window, but it will re-appear anytime you attempt to launch any Easify Pro feature that relates to money. Which in actual fact is most of Easify, so this option is only really used to dismiss the window while you decide what your VAT status is.

If you are VAT registered, select the "My company is registered for VAT" option. This will allow Easify to record VAT relating to your sales and purchases.

If you are not VAT registered choose the "My company is not registered for VAT" option. This will tell Easify that you do not wish to record VAT information related to your sales and purchases.

Don't worry if you need to register for VAT at a later date, or change your tax status, Easify will handle that change for you. Once you have registered with HM Revenue and Customs, all you need to do is click on Tools on the Main Menu and then VAT Settings to get through to the option to change your VAT registration status with Easify.

Whether you set your VAT registration status now or opt to set this later, clicking on OK will close this window and take you to the Main Form.

As noted in this window, certain activities require that the VAT registration status set before you can make use of them. This window will be displayed again upon accessing those activities to prompt you to set the status.

Click here to read the next getting started article - Preparing to Add Products