VAT Settings

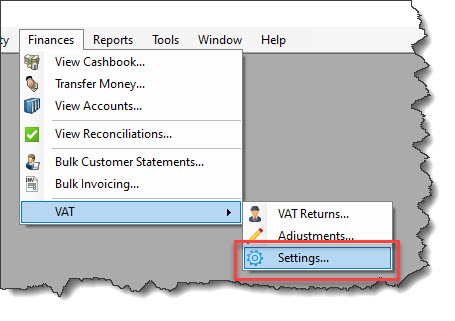

As from V4.80 the VAT Settings have moved to the Finances menu, where you will also find links for VAT returns and VAT adjustments. Before V4.80 the VAT Setting were under the Tools Menu.Easify has full support for VAT and allows you to fully customise your VAT rates and settings should you so desire.

As standard Easify is configured with a default set of VAT rates, these should suffice for most small businesses but feel free to change them if you need to.

VAT Settings can be accessed via the Finances-> VAT-> Settings menu.

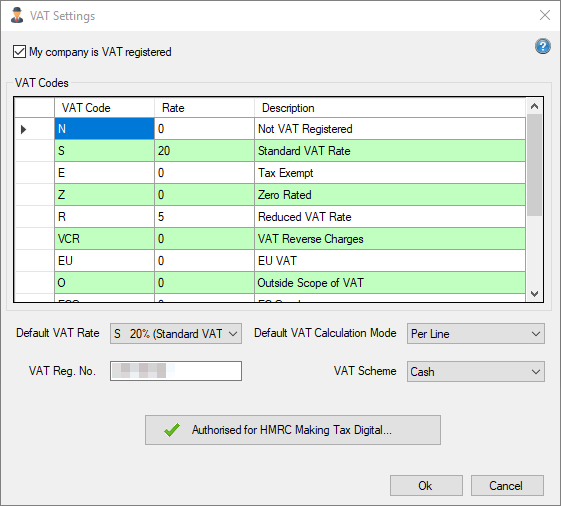

The VAT settings window lists all of the VAT rates that can be assigned to your products.

VAT Registration

At the top of the window is a tick box that is used to specify whether you are VAT registered. This will have been set automatically when you were first asked by easify whether you are VAT registered. If you de-register for VAT you can untick this box and Easify will revert to non VAT registered mode.

Equally, if you become VAT registered you can tick this box and Easify will switch to VAT registered mode.

When you tick the My company is VAT registered tick box, Easify will add the relevant VAT controls and columns wherever they are needed. Easify will also print VAT details on all your paperwork.

VAT Codes

Each VAT rate has a VAT Code and a description. You can either accept the default VAT rates, codes and descriptions that we have created or if you want to add a new VAT rate, simply type it into the blank row at the bottom of the list of VAT rates.

Default VAT Rate

The Default VAT Rate drop down list allows you to specify which VAT rate you would like to automatically assign to new products that you add to Easify.

Default VAT Calculation Mode

Here you can choose how you want Easify to calculate VAT on your products.

Easify supports two ways of calculating VAT on your products and services, Per Item and Per Line.

Per Item

This was the original calculation method used by Easify prior to Easify V4.54. Per Item VAT calculation calculates the VAT for each item and then multiplies the value by the quantity of the products on the line.

When we refer to line we simply mean a product on an order, in other words when you add a product to an order it is known as a line because it occupies one line on the order.

Calculating VAT per item was the original VAT calculation mode in Easify because Easify was heavily geared towards EPOS use in a retail environment. Calculating VAT and then multiplying by quantity can lead to more accurate sale totals at the POS due to the inclusive of VAT price exactly matching the ticket or price label price.

However if you use large quantities of low value items on a single line this method can lead to small value VAT rounding for certain prices.

Per Line (default)

This VAT calculation mode was introduced in Easify V4.54 and is now the default VAT calculation mode used by Easify.

With Per Line VAT calculation, the exclusive of VAT price is multiplied by the product line quantity before the VAT is calculated.

This means that small value VAT rounding does not creep in when there is a quantity of items on a single line.

The Default VAT Calculation method selected here will be used for all new Quotations and Orders that you raise in Easify, however you can override this setting on an individual quote or order if you wish.

Default VAT Calculation method does not apply to purchase orders as it is possible to override the VAT content of a purchase manually so that you can record the VAT as it was calculated and charged by your supplier.

VAT Reg. No.

This is your company's VAT registration number which can be entered with or without the "GB" prefix. However we recommend inserting your code with no spaces or hyphens etc.

VAT Scheme

Easify supports the 2 main VAT Accounting methods:

- Standard VAT Accounting – the VAT is due on the invoice or purchase date.

- Cash VAT Accounting – the VAT is due when the invoice or purchase is paid.

Authorised for HMRC Making Tax Digital

This button is used to authorise Easify to connect to HMRC for the purposes of submitting MTD VAT Returns.

Change in VAT Rates

When a VAT rate changes it is very easy to handle this in Easify. Say the government raises the standard rate of VAT from 20% to 25% all you need to do is open the Easify VAT Settings window, and change the standard VAT rate from 20 to 25 and click Ok. That's it.

Once you have changed a VAT rate, Easify will prompt you whenever you open an active order that has the old VAT rate on it as to whether you would like to adopt the new rate of VAT or stay with the old one for that order. This way you will be able to decide whether to invoice the order at the old VAT rate or the new depending on your accounting needs.

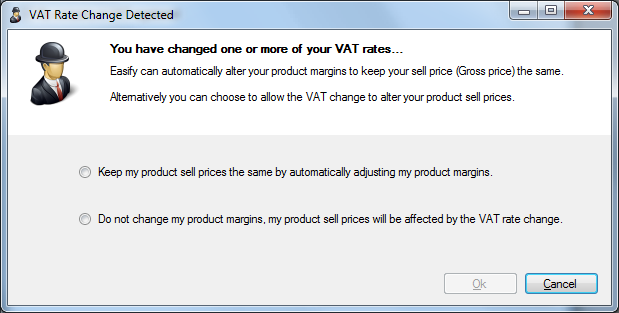

When a VAT rate changes your business will have the option of absorbing the VAT change and keeping your sell prices (gross prices) the same, or of passing the VAT change on to your customers.

Easify supports both scenarios and when a VAT rate changes you will be asked which action you would like to take.

If you would like Easify to keep your sell prices the same by adjusting your product margins then select the top option.

If you prefer to pass the VAT rate change onto your customers then select the bottom option.

International Settings

The screenshots above are shown with Easify Regional Settings set to United Kingdom. If you have chosen a different country then the word VAT will be replaced with the name of the Tax system that your country uses.

You will also need to edit the list of tax rates to match those that are used in your country.