Writing Off an Order

If you need to write off an order e.g as a bad debt, then please follow the steps below.

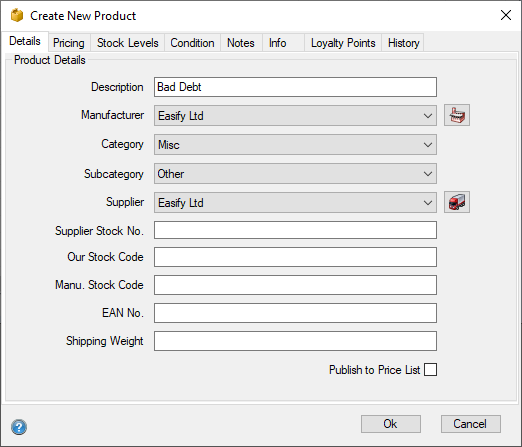

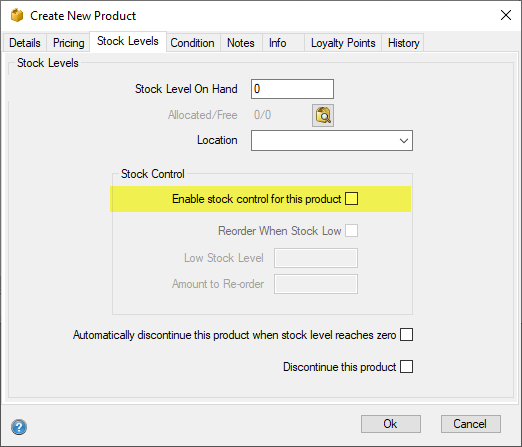

Add a new product

- Firstly, ensure that the category in which you create the product is VATable. You can check this under Tools Options Purchases.

- Name the product "Bad Debt" and disable stock control for it.

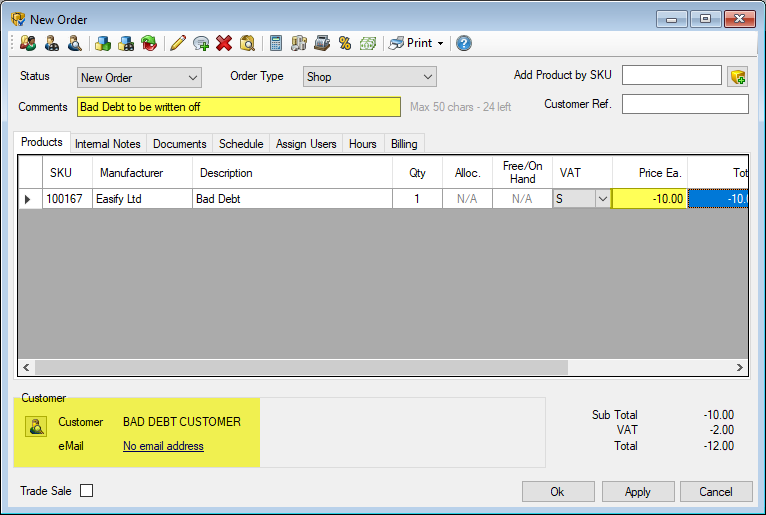

Create a new order and add the Bad Debt product to it

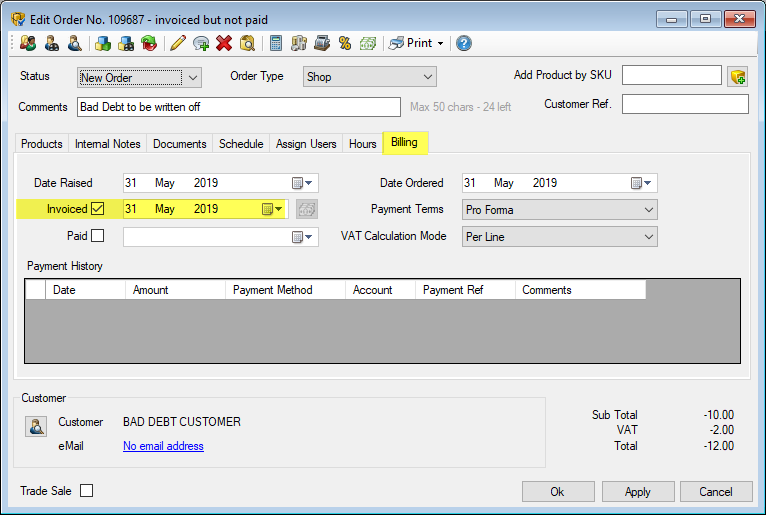

- Add a comment i.e "Bad Debt to be written off" or similar

- Make the value of the product a minus figure (i.e change the Price Ea. to be a minus figure)

- Add the customer who has not paid to the order

Tick the Invoiced box and make sure that the Invoice Date is inserted

If the Invoice Date is not inserted then it won't be included on the VAT Return for that period if you are using Standard VAT accounting. If you are using Cash VAT Accounting, your VAT liability is based on your payment date and you will need to ensure that a refund payment is processed for the order and that the "Paid" date is inserted.

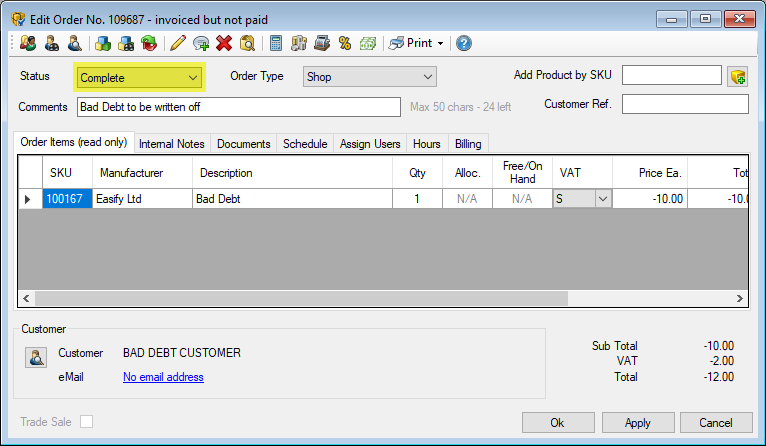

Move the order status to "Complete"

This will then ensure that the VAT element will be subtracted from the Sales VAT when you file your next VAT Return.