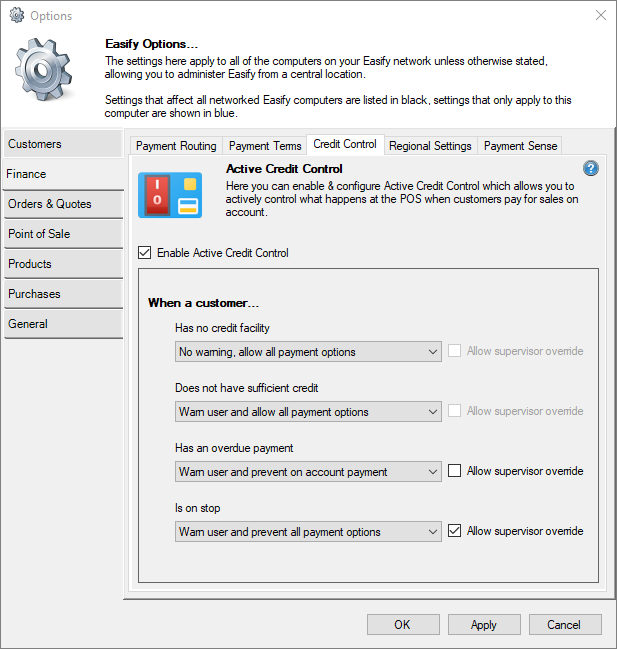

Finance Credit Control Options

You can enable Active Credit Control in Easify in order to determine what happens in the Point of Sale (POS) when a customer tries to pay for a sale when they don't have sufficient credit, have an overdue payment, or have been put on stop.

Click here to learn more about using Credit Control in Easify...

Enable Active Credit Control

Tick this option to enable Active Credit Control.

If this box is left unticked, no credit control checks will be applied to customers making purchases at the POS.

When a customer...

Here you have a number of credit check scenarios, and can choose the action that you want to happen "when a customer" matching the credit scenario attempts to pay for a sale at the POS.

Some of the actions have the ability to be overridden by a supervisor with suitable permissions in Easify.

Has no credit facility

This scenario occurs when a customer tries to pay for a sale on account, but they have a zero credit limit set on their customer record.

Does not have sufficient credit

This scenario occurs when a customer tries to pay for a sale on account, but they don't have enough credit available e.g. the amount they want to pay for on account exceeds their credit limit minus how much they already have on credit with you.

Has an overdue payment

This scenario occurs when a customer tries to pay for a sale on account, but they have a late payment for a previous purchase.

Is on stop

This scenario occurs when a customer tries to pay for a sale on account, but they have been placed on stop.

Customers can be placed on stop on the Account tab of their customer record in Easify.

Click here to learn more about editing customer records.

You can choose from the following actions for each credit scenario:

No warning, allow all payment options

Choosing this option means nothing will happen when the user tries to take a payment in the POS.

No warnings will be displayed, and the payment will be accepted.

Warn user and allow all payment options

With this action, a message will pop up on the screen telling the user that the customer has failed a credit check in Easify, however the payment can still be taken by any means.

This gives your staff the opportunity to choose what action to take if a credit issue is flagged to them.

Warn user and prevent on account payment

The user will receive a pop up warning about the credit problem when they attempt to take payment, and they will be prevented from taking any payment amount "on account".

The customer can still pay for the sale via cash, card or cheque.

You can set this action to allow a supervisor override, so that a supervisor can authorise payment on account by entering their username and password.

Warn user and prevent all payment options

The user will receive a pop up warning about the credit problem when they attempt to take payment, and they will be prevented from taking any payment via any method.

You can set this action to allow a supervisor override, so that a supervisor can authorise payment by entering their username and password.

This action effectively prevents any payment from being taken unless overridden by a supervisor.

If you have multiple active credit scenarios, Easify will chose the most harsh one to implement. These are the levels of harshness from least to most harsh:

- No warning, allow all payment options

- Warn user and allow all payment options

- Warn user and prevent on account payment

- Warn user and prevent all payment options

Allowing supervisor overrides

Some of the actions have the option to allow a supervisor to override the credit control action.

If the Allow supervisor override option is greyed out and disabled, it means there would be nothing for a supervisor to override for that action. For example, if you choose the No warning, allow all payment options action for a credit control scenario, there would be nothing for a supervisor to override.

In order for a supervisor to be able to override a credit control action, they need to have the User is allowed override credit control warnings. permission in Easify.

Click here to learn more about user permissions in Easify.

If a credit control action allows for a supervisor override, when the payment is blocked in the POS a login prompt will popup, and if a user with the aforementioned permission enters their username and password then the credit check action will be bypassed. This is a good way of getting your staff to gain approval before making decisions about credit issues.