VAT - Retail Scheme and Invoicing etc

Hi

If I produce an invoice that is two pages long and then use the 'save invoice to documents folder as .pdf', the result is that it will save it as two pages, but it is just the first page replicated twice and not two different pages.

The way I get around this is to use the method above, but then use the 'save as' feature which I then save as the previous file i.e overwrite it. This produces the document correctly. This happens every time I have a document more than one page long, why is that? ![]()

I have completely uninstalled Easify and re installed in a failed attempt to get rid of the EASU screen after downloading the trial. I had to do this regardless that I had uninstalled it in windows control panel, but it never worked anyway ![]()

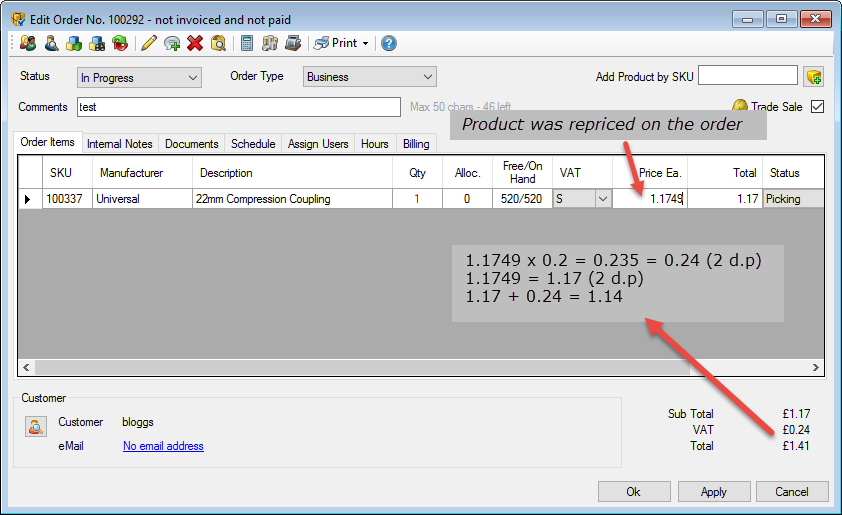

On the subject of VAT again, please see the following attachments

[Missing attachment: VAT example 1.jpg]

[Missing attachment: VAT example 1.jpg]

The net price is £1.17, VAT £0.24p and total is £1.41, therefore the VAT is calculated as 20.51% of the net price

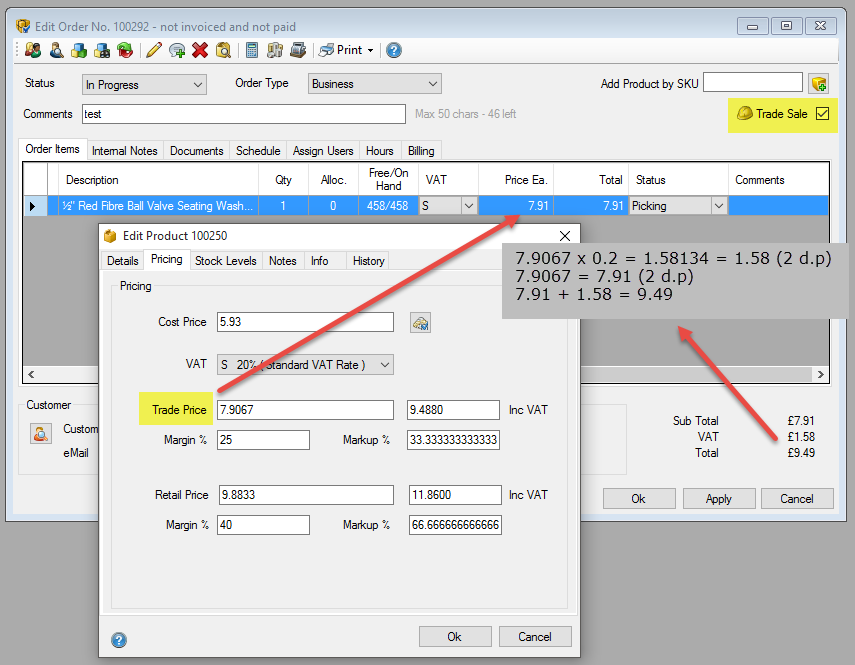

The next item.....

[Missing attachment: VAT example 2.jpg]

[Missing attachment: VAT example 2.jpg]

This shows a product for sale at £7.91, VAT £1.58 and total ££9.49, therefore the VAT is calculated as 19.97% of the net price

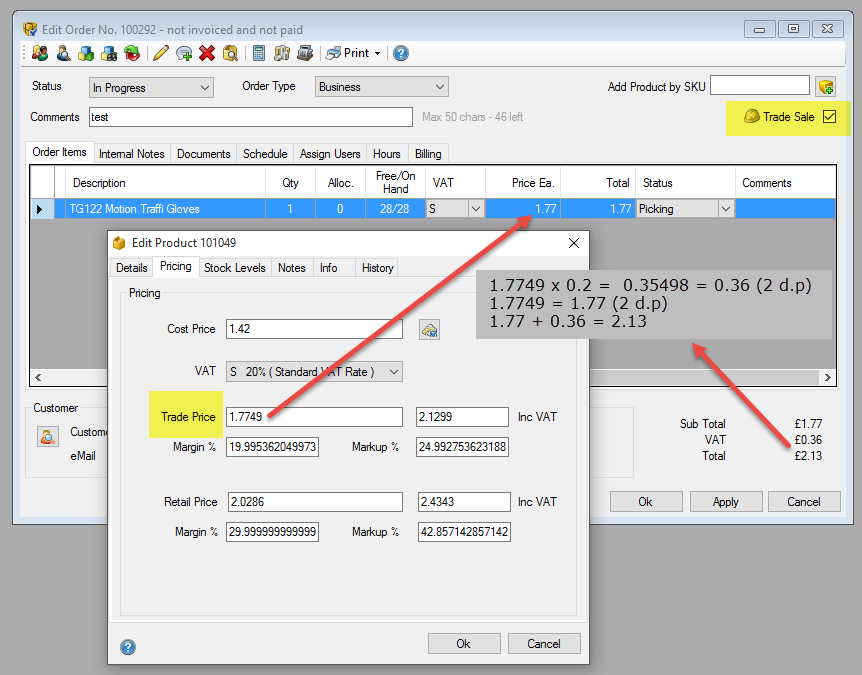

One more item to illustrate the point.......

[Missing attachment: VAT example3.jpg]

[Missing attachment: VAT example3.jpg]

This shows a product for sale at £1.77, VAT £0.36 and total £2.13, therefore the VAT is calculated as 20.33% of the net price

I don't understand why this happens instead of creating everything as 1.2 (+20%) of the net price. I understand that easify uses the VAT retail scheme as mentioned in a previous post, but not sure why this difference occurs........can you shed any more light on it?

Also, HMRC VAT notice 727/4 retail schemes, paragraph 2.4 states that 'sales to other VAT registered businesses must not be included in a retail scheme'

Here is the link for your convenience... https://www.gov.uk/government/publicati ... ent-scheme

How do we sell to other VAT registered companies using easify so that the VAT calculates correctly?

I Understand that we are able to change the VAT on a purchase order but how is that done on a customer invoice?

Thanks in advance

Gavin