Easify News - 19th March 2019

Easify V4 - Update #9 (4.61) has been released...

We are pleased to announce that Easify V4.61 has been released.

Take me straight to the download!

You can download the latest version of Easify Version 4 here...

What's new in Easify version 4.61?

Reconciliations

As it is good business practice to reconcile your accounts on a regular basis and before submitting a VAT return, we have introduced a Reconciliation feature. This is the first step towards Making Tax Digital (MTD) - but don’t worry, this isn’t the only thing we’ve been doing to become MTD compliant.

Our developers are currently in the process of obtaining approval with HMRC for Easify to become fully accredited for MTD, so you will be able to submit your VAT returns to HMRC using Easify.

The new reconciliation feature within Easify will help ensure your accounts are correct and that everything has been accounted for before submitting your VAT return. You will be able to check all your sales and purchases against your bank statement over a specified period of time to ensure that everything matches up and that nothing has been missed.

Each account that you use in Easify can be reconciled (e.g Paypal, Current, Business Credit Card accounts) and you can set different criteria for each account.

You can save reconciliations so you don’t have to complete them in one go and once a reconciliation is completed the records within it will become read only to prevent you from inadvertently changing anything that has already been reconciled and on a VAT return.

Completed reconciliations will also be saved and easy to access so you can always check to see when a transaction was reconciled.

For more information, please follow the link to our set of Reconciling help articles here: https://www.easify.co.uk/Help/finance_reconciling

Improvements in 4.61

- Added a Supplier picker button to the Purchases main window.

Bug fixes in 4.61

- Fixed an issue in Cashbook where sorting using Date column did not display the entries in date order.

- Fixed an issue where user settings for window positions were not being saved when Easify Pro was closed.

- Fixed an issue where if whitespace was present at end of order comments, documents couldn't be saved to the DMS.

- Fixed an issue in the Products window where sorting by Condition column did not sort alphabetically.

- Fixed an issue where an error message would display when attempting File -> Export -> Sales…

- Fixed an issue in the Products window where allocated stock was not factored in for low stock colour coding.

Coming Soon...

Making Tax Digital

Currently (as of March 2019) we are in the final stages of achieving HMRC approval for Easify Pro with respect to meeting the requirements of Making Tax Digital for VAT.

We have a number of new updates for Easify Pro that will be released once we have achieved HMRC approval to go live with the MTD API.

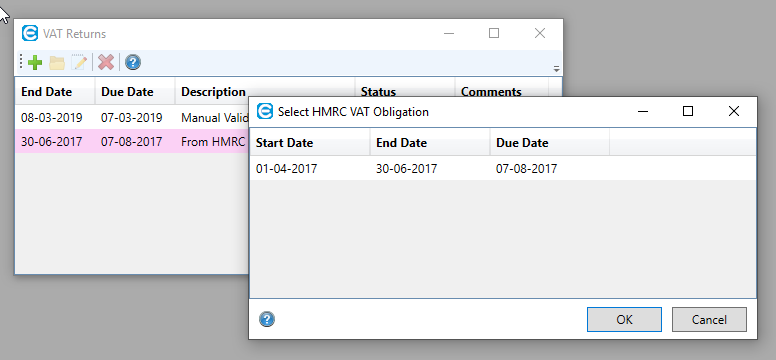

When we release the new code, you can continue to use Easify in pretty much the same way you always have recording your sales and purchases. You will be able to download VAT Return obligations from HMRC and generate the corresponding VAT return digitally within Easify Pro.

You will be able to review all of the transactions that go to make up your VAT return and export them so that you and your accountant can check them over. When you are happy with the generated VAT return, you simply click a button and it will be submitted to HMRC for you.

Payment Plans

As part of the forthcoming Making Tax Digital update, we will be introducing the ability to create payment plans for orders and purchases.

With this you will be able to more easily invoice your customers for deposits and part payments, and this will tie in perfectly with new VAT Returns system.

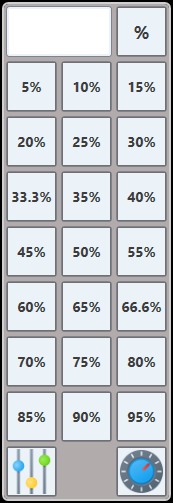

Simply open an order and click the new Payment Plans button, you will be able to create as many instalments for an order (or purchase) as you need, and we've also included a handy instalment calculator to help you quickly proportion the payments.

Many thanks to everyone that has helped us by submitting bug reports. Please don't hesitate to let us know if you encounter problems ASAP and we will get them resolved as quickly as we can.

FAQs

I have an Easify Cloud Server, how do I upgrade?

With the Easify Cloud Server, we handle your Easify Server upgrades for you. Simply send us an email telling us when is a convenient time for the upgrade and we will upgrade your Easify Server to the latest version.

Do I need to upgrade from V3 to V4 before upgrading?

No, if you wish to upgrade from Easify V3 you can go straight from Easify V3 to V4.61 by running the Easify V4 installer.

I am an Easify V4 user, are there any technical reasons that would prevent me upgrading to V4.61?

No, anyone who is using Easify V4 will benefit from the update.

You can download the latest version of Easify Version 4 here...