Purchase orders and VAT

The invoices we receive from suppliers does not match up with the purchase orders that we produce on Easify.

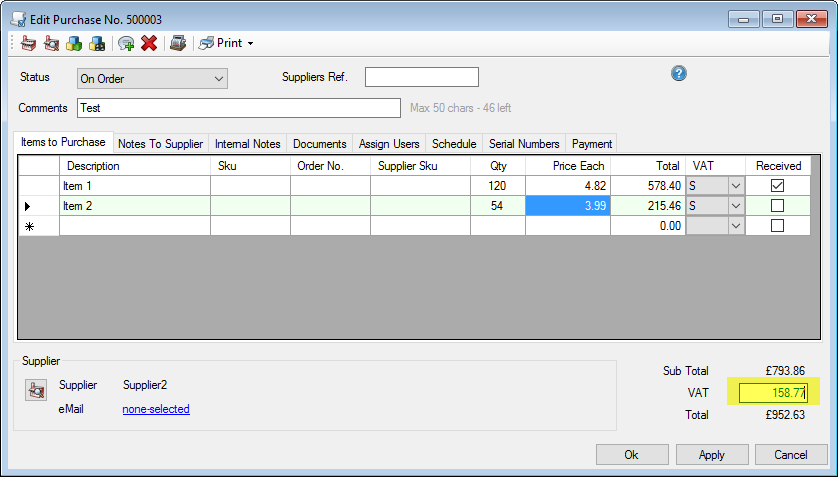

For example, we have 2 products on a purchase order..........

Item 1 - quantity 120 @ £4.82 each (cost price in products) total £578.40

item 2 - quantity 54 @ £3.99 each (cost price in products) total £215.46

Sub total - £793.86

VAT is standard rate @20%

so far so good

But then Easify adds £158.40 VAT, which is 19.953% and not 20%

The total purchase order value is then £952.26 instead of £952.63. It's not a huge difference, but does mess up our records. Why does it do that and is there a fix for it?

I've also noticed that the margin and VAT is incorrect for products as well. For example we have inputted a product with a cost price of 35p with a margin of 15% which easify then shows a trade price of .4118p which is actually 17.657% and not 15%? The VAT inclusive trade price is then .4942 which is near enough to an extra 20% on top of the .4118p figure. I don't understand why this happens or how we can rectify it without producing everything manually

Please help

Thanks

Gavin