Exporting VAT Return data

Before submitting your VAT return we STRONGLY recommend exporting the date to a .csv file (which can be opened by excel) so you can check that you are happy it is correct.

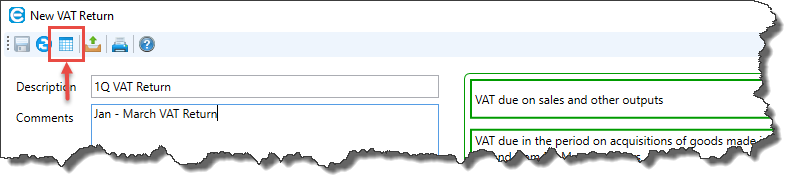

The option to export VAT return data can be found in the menu bar along the top of the Edit VAT Return window:

The .csv file includes the following data:

- Date

- Our Ref

- Type (whether purchase or sale)

- Sub Type

- Comments – Customer name – followed by Order or purchase comments

- NET

- VAT

- Reconcile (False or True)

- VAT Box No

The following VAT boxes appear on your VAT return:

- Box 1 - VAT due on sales and other outputs

- Box 2 - VAT due on acquisitions of goods made in Northern Ireland from EU member states

- Box 3 - Total VAT Due (the sum of boxes 1+2 generated by system)

- Box 4 – VAT reclaimed on purchases and other inputs (including acquisitions in Northern Ireland from EU member states)

- Box 5 – NET VAT to be paid to HMRC, or be reclaimed by you (difference between boxes 3 & 4 generated by system)

- Box 6 – Total value of sales ex VAT

- Box 7 – Total value of purchases ex VAT

- Box 8 – Total value of dispatches of goods and related costs (excluding VAT) from Northern Ireland to EU member States

- Box 9 – Total value of acquisitions of goods and related costs (excluding VAT) made in Northern Ireland from EU member States

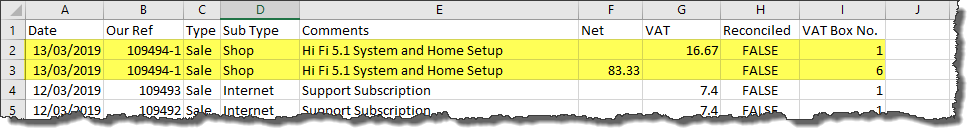

The data exported in the .csv file is displayed via which VAT box it appears in – so an order might show two or more times on the .csv file as shown below:

In the scenario above you can see that order no 109494-1 on the first line shows £16.67 in the VAT column and VAT Box 1.

This means that the VAT element which is £16.67 is being recorded in VAT box 1 - VAT due on sales and other outputs.

In the scenario above you can see that order no 109494-1 also shows £83.33 on the second line in the NET column and VAT Box 6.

This means that the NET price which is £83.33 is being recorded in VAT box 6 - Total value of Sales ex VAT.