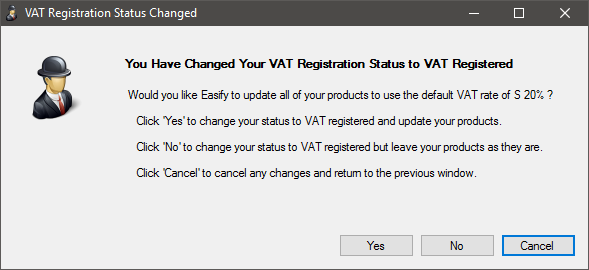

VAT registration

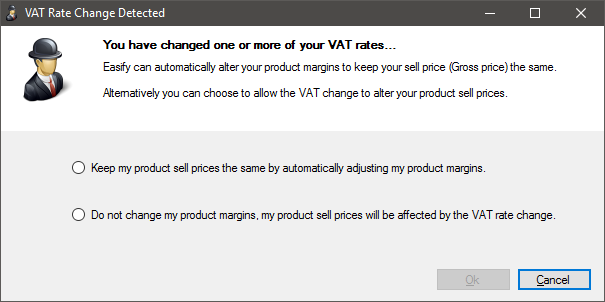

As we now (from 1/8/16) have to register for VAT I'm wondering what sort of process this is on Easify, before I actually do it. At the moment our prices are all gross (purchases & sales). Prices will stay the same but will obviously have to be split for net & VAT. Will I have to alter the price on every stock item (currently over 600) or is there something in the system that will do this automatically?

On the same sort of thing, when we get price increases in January, does everything have to be altered manually or is there something to increase prices from a certain supplier by, say 3%?

Fingers crossed .......